Set your goals and prepare for Tax Day

Key takeaway:

- Use your personal and financial goals to your advantage to help get ahead of Tax Day.

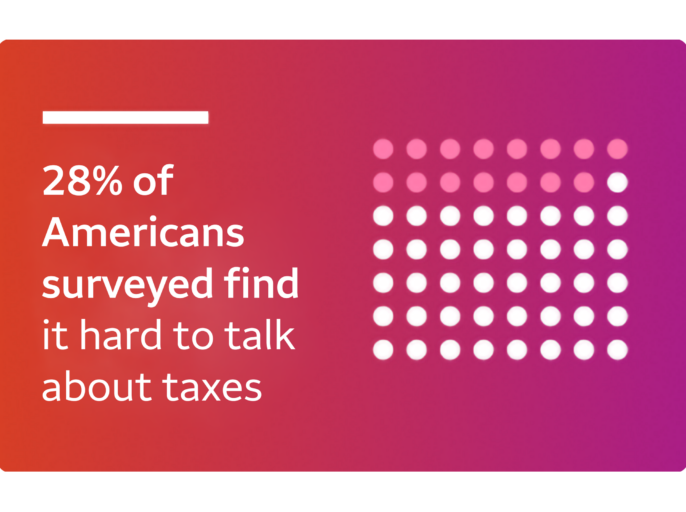

Talking about taxes and other money matters is difficult, and how you earn, spend, and save your money may impact the taxes you pay.

What can you do to help make the most of your refund and support your personal and financial goals?

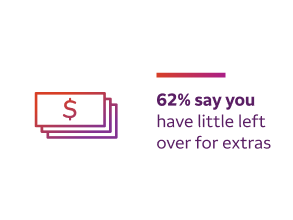

Tip: If you receive a refund, consider using it toward your “extras” for the month: allocate toward one of your goals (such as retirement, education, or an emergency fund), invest it for longer-term use, or treat yourself to a nice dinner out.

Tip: Be prepared for the next tax season! Set up a tax goal in LifeSync and begin managing your personal finances or start the conversation with your tax professional to get ahead.

Tip: Align your money with your values and potentially save on your taxes for 2024! One way may be through charitable contributions — tying an organization(s) to your goal and determining with your tax professional how your contributions may impact your taxes.

Get your goals in sync with LifeSync to help take control of your money story.

Wells Fargo & Company and its affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

About the study: On behalf of Wells Fargo, Versta Research conducted a national survey of 3,403 U.S. adults and 203 U.S. teens age 14 to 17. Sampling was stratified and data were weighted by age, gender, race, ethnicity, income, and education to achieve accurate representation of the current population based on estimates from the U.S. Census Bureau. The survey was conducted from September 5 to October 3, 2023. Assuming no sample bias, the maximum margin of error for full-sample estimates is ±2%. Most findings are reported based on the full sample of adults. Comparisons and data from teens are noted separately.